In the News…

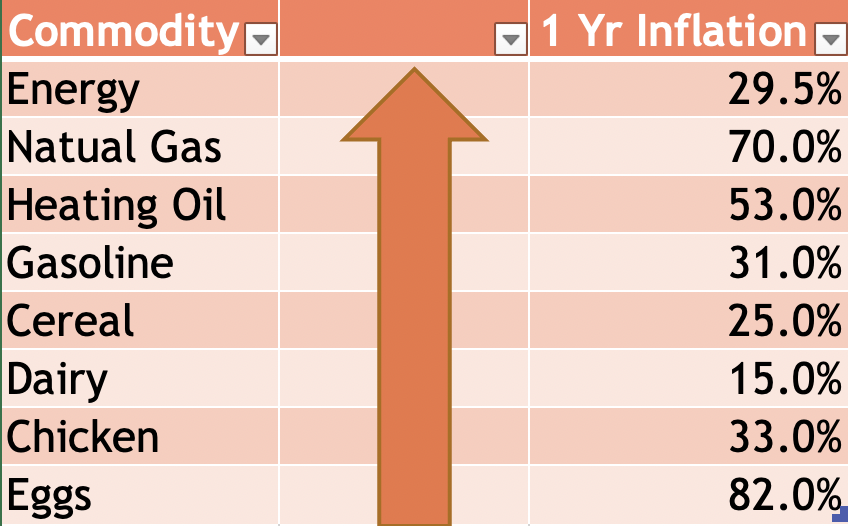

The August Consumer Price Index came out on Tuesday reflecting 8.3% inflation which was worse than expected and which remains at 40 year highs. But is that the real inflation rate? Below are some of the most used commodities and the impact inflation is having upon them and us as consumers.

Energy prices are going through the roof as was recently evidenced by the notices we received in our PECO bills notifying us of the 11% increase in electric rates effective September 1st. Those who don’t use electricity to heat their homes this winter, will also be feeling the burden of increased heating oil and natural gas costs. According to a Wall Street Journal analysis, the Biden Administration’s Department of the Interior has given out leases for oil and gas drilling on federal land on 126,228 acres. As OANN reported, “the last president to lease out less than 4.4 million acres at this point in the first term of his presidency was Richard Nixon in 1969-1970.

Is it ironic that the Biden Administration was throwing an “inflation reduction” party the same day that the numbers came out higher than expected and markets were crashing or a lame attempt at distraction? Or, perhaps it was something else…

As G. K. Chesterton wrote, “It isn’t that they can’t see the solution. It is that they can’t see the problem.”

We are trying to make sure that they see and understand the problems. Join us in that mission!