Tariffs – Justified?

A tariff is a fee imposed by one country on goods or services imported from another country, but tariffs are only one tool used by governments to manage international trade. Most governments use tariffs and other trade barriers to protect domestic producers of critical and high-value goods, and to maintain large trade surpluses to help their economies grow and develop high-value, high-skilled jobs. The United States has always used tariffs, but not at the level of our trade partners.

China uses a complex mix of tariffs, export duties, export subsidies, currency manipulation, standards and trade deals to ensure they capture critical industries and jobs. The Chinese government also provides access to low-cost capital and other support for companies to capture global market share. As a result of China’s trade policies and the willingness of U.S. and European nations to support China’s growth through trade deficits and foreign direct investment, China is now the second largest economy in the world overtaken only by the United States and the combined economies of the European Union.

Until the ratification of the 16th Amendment in 1913, which allowed Congress to impose a federal income tax on citizens, tariffs were the backbone of U.S. government revenue, funding over 90% of federal budgets.

First Trust Advisors, LLP recently did an analysis of the new federal policies around tariffs and their potential impact on the economy. Here are our takeaways:

ECONOMIC INDEPENDENCE

The administration’s latest tariffs could raise U.S. revenue by 0.85% of GDP, which is the largest peacetime tax increase since 1982. The strategy is to level the playing field in global trade and restore America’s economic independence. Prior to the implementation of new tariff policies, the U.S. tariff rate was at just 3.3%, compared to 7.5% from China and 17.0% from India. There is clearly room to negotiate new trade deals.

** NOTE: A list of current worldwide tariffs (following federal policy changes) can be found at worldscorecard.com.

SHORT-TERM PAIN/LONG-TERM GAIN

Tariffs can mean higher costs for imported products, which may impact spending. According to First Trust, the tariffs and spending cuts will expose the economic weaknesses hidden by years of reckless deficits – over 6% of GDP in 2023 and 2024. But, we’ve been here before! In the Reagan years, they tackled inflation and government bloat, enduring a tough transition before unleashing an economic boom. By encouraging companies to produce in America, tariffs can create jobs and more secure supply chains, reducingU.S. dependence on other countries like China. As First Trust put it:

MARKETS

Market volatility is a concern for many. Although the dips are being blamed on the impact of tariffs, it is more likely a realignment due to overvaluation. In January 2025 the S&P 500 had a price-to-earnings ratio of 28, compared to a level of 8 in the Reagan era. Currently, only 10 stocks make up one-third of the S&P 500’s value. The last time tariffs were used by this administration, there was also market volatility. However, from 2017 to 2021 the market climbed 25% while inflation stayed low.

TRADE SMART – PRIORITIZING AMERICA

According to tradingeconomics.com, in 2024 the top U.S. import partners were Mexico ($510 billion), China ($463 billion), and Canada ($421 billion). Those same countries also led in purchasing U.S exports. Canada led in exports ($348 billion) with Mexico not far behind ($334 billion). The U.S. only exported $144 billion in goods to China. Total U.S. exports to each country were significantly less than our imports.

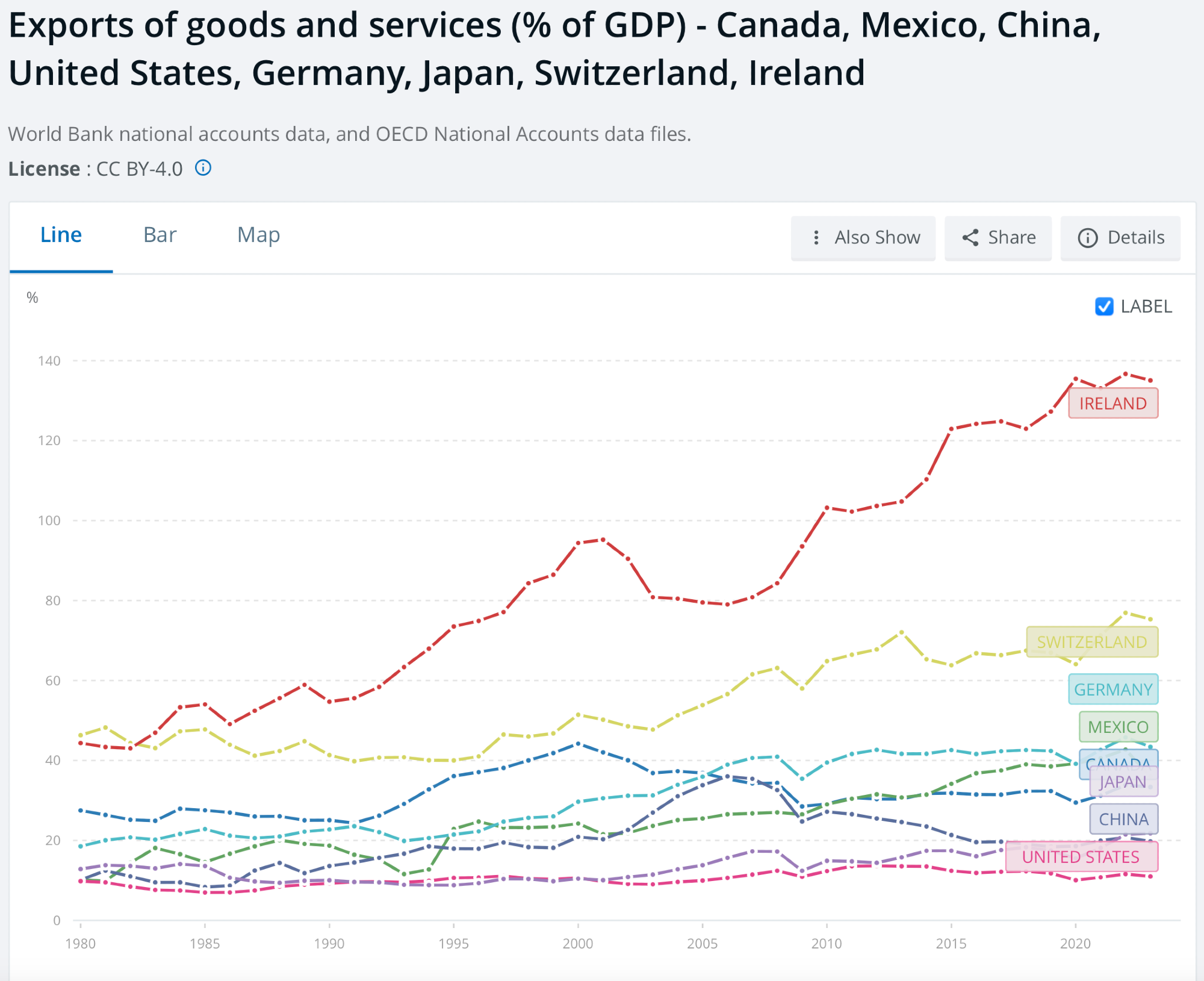

As noted above in the graph of Exports as a Percentage of GDP from 1980 to 2023 from the World Bank, the U.S. averages approximately 11% of GDP in exports, whereas our other major trading countries export at a rate of 20%-135% of GDP. The United States clearly has leverage to push for fairer trade terms without crippling our economy.

Changes to federal policies already seem to be revitalizing American’s industrial base with construction of new auto and semiconductor plants recently being announced in the United States. Tariffs seem to be helping to shift production to America, which strengthens our economic and national security.

Bottom line…

Tariffs are more than taxes. They are tools to rebalance global trade which has been manipulated by our trade partners. They protect American jobs, counter globalization’s excesses, and rebuild our industrial might. But, they must be used properly. Pairing tariffs with deeper tax cuts and aggressive deregulation can ignite the U.S. economy and spur investment. Using tariffs to negotiate lower foreign trade barriers will open markets for American exporters.

Tariffs are a bold step toward a stronger, self-reliant America. Yes, there might be some short-term pain, but as Reagan showed, tough choices today can unlock prosperity tomorrow. Let’s stay the course and build an economy that puts America first!

As the Constitutional Convention ended in 1787, Benjamin Franklin was asked if the delegates produced a monarchy or a republic. Franklin replied, “a republic, if you can keep it.”

We are trying to keep this republic that we love and hold our representatives accountable to the people. Join us in that mission and share this Update with your contacts!