Montgomery County 2025 Budget

The Montgomery County 2025 fiscal year budget that was passed by the County Commissioners is composed of 10 individual budgets which total a whopping $1.298 billion. Each fund budget was passed unanimously with the exception of the General Fund budget, totaling $610.9 million, which passed by a 2-1 vote. This year’s General Fund budget represents a 8.4% increase over 2024. The $15.8 million budget deficit will be funded by debt and reserves. We reviewed Montgomery County’s budget and here are a few of our takeaways:

General Fund Budget Expenditures

- Health & Human Services: $224 million (36.6%)

- Judicial: $110 million (18%)

- County Administration: $100 million (16.3%)

- Corrections: $83 million (13.6%)

- Debt Service: $70 million (11.4%)

- Public Safety: $12.9 million (2%)

- Other: $10 million (1.6%)

General Fund Budget Revenue Sources

- Real Estate Taxes: $321.9 million (54%)

- Federal & State Grants: $206 million (35%)

- Departmental & Other: $67.2 million (11%)

Additional Thoughts

9% County Tax Increase?

We discussed the county’s 9% tax increase in our 12/20/24 email, which can be seen here. Those higher tax dollars help fund the majority (54%) of the General Fund. However, according to a recent report from Pennsylvania’s Independent Fiscal Office, the county’s tax hikes never stop! Over the last 10 years, Montgomery County residents have seen a 109% rise in their taxes. Montco ranks #2 amongst all the commonwealth’s counties for their tax hikes over 10 years!

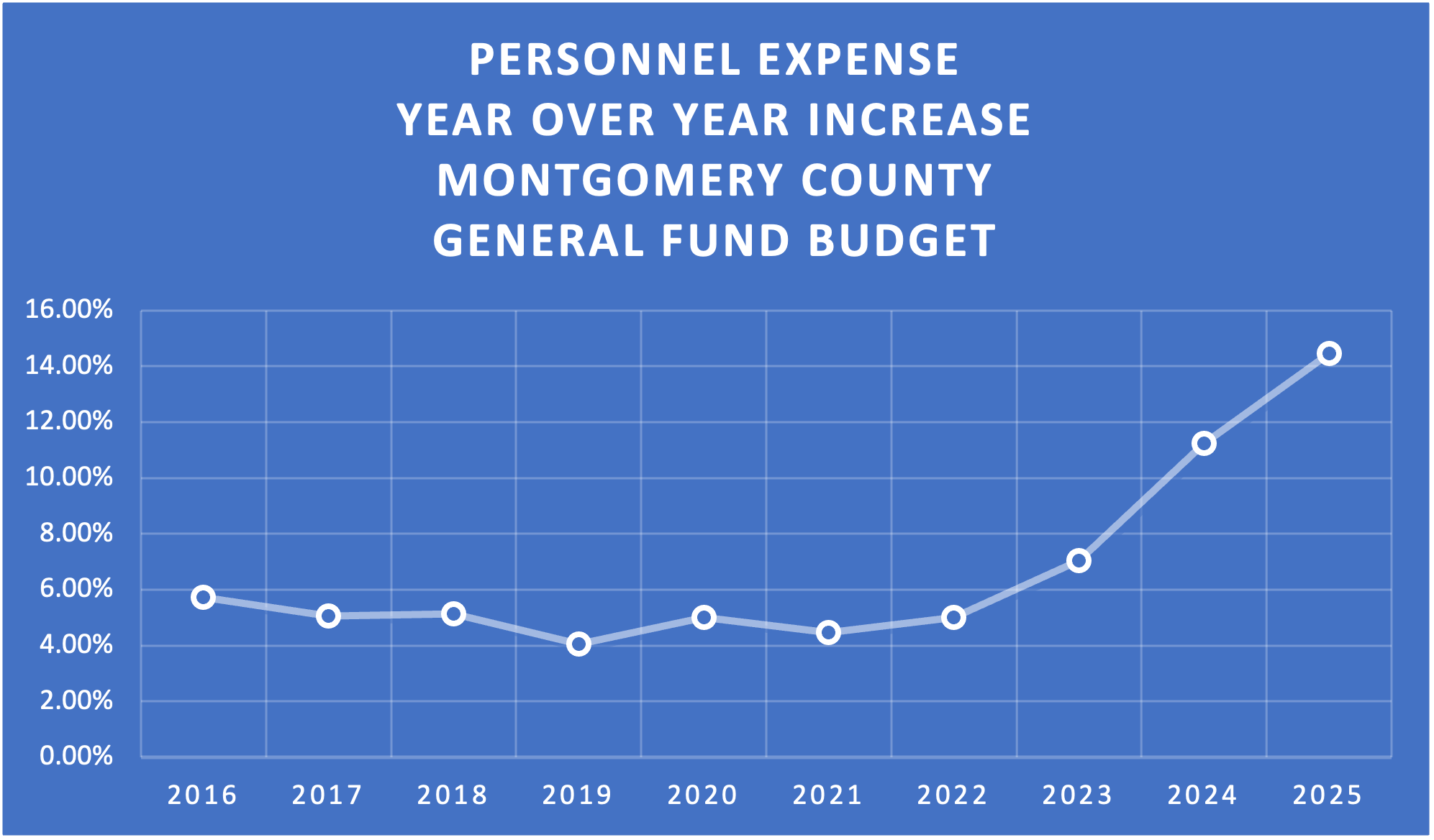

Personnel

County employee payroll/benefits make up 47.7% of the General Fund budget, the largest expense item for the county, as it has been for many years. However, over the last three years, the personnel expenses have climbed dramatically over the historic average yearly increases, culminating in a 14.5% year over year change in the 2025 budget.

This year that 14.5% increase in personnel expense amounted to $36.8 million! In the county’s budget presentation, they clearly note that personnel expense is a major factor (along with debt service costs) contributing to the budget deficit. So, what’s the plan? “Closely monitor expenses and outperform the 2025 budget on an actual basis.” Does that sound like an effective plan to cut expenses and balance the budget to you?

Federal & State Grants

More than one-third of the county’s anticipated revenue is derived from federal and state grants. $193 million or 94% of General Fund grant revenues go to community health and well being for the young and old including the Early Learning Resource Center, the Office of Children and Youth, and the Office of Aging Services. Will the federal government’s D.O.G.E. efforts reduce the amount of funding to the commonwealth and county? If that happens, how will the county adjust? More tax increases?

Bottom line…

Montgomery County has relied on taxing its citizens more and more each year to fund the growing county government. It seems that the county isn’t even concerned about running a deficit budget, since it’s been doing that since 2020! The county commissioners tax and borrow to increase the size of government at a time when residents struggle to meet their own financial obligations. As elected leaders, perhaps the commissioners should learn fiscal restraint! Managing a municipality, a county, a commonwealth, or a nation sometimes involves making difficult decisions. It seems at least two of the Montgomery County Commissioners need to grow spines!

As the Constitutional Convention ended in 1787, Benjamin Franklin was asked if the delegates produced a monarchy or a republic. Franklin replied, “a republic, if you can keep it.”

We are trying to keep this republic that we love and hold our representatives accountable to the people. Join us in that mission and share this Update with your contacts!